irs child tax credit problems

Earned Income Tax Credit. Contact the Taxpayer Advocate Service TAS.

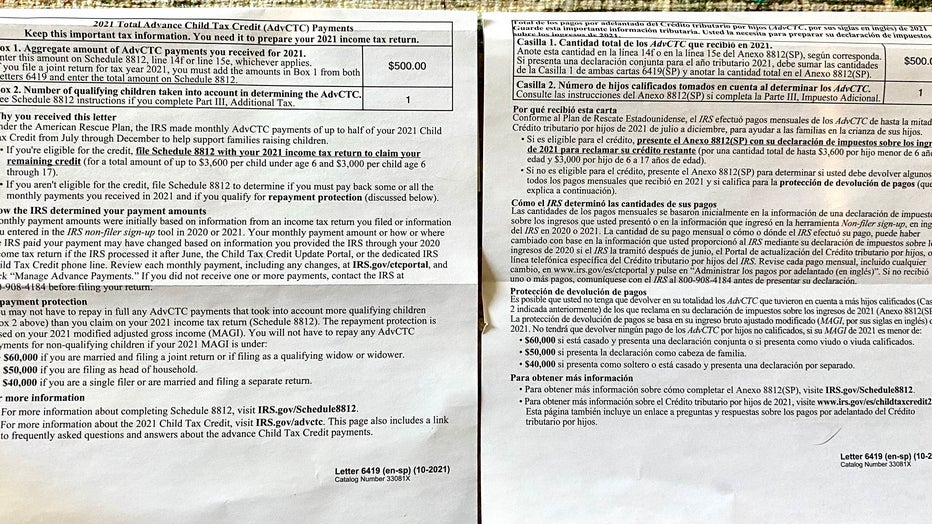

Advance Child Tax Credit Filing Confusion Cleared Up

As if the IRS.

. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Known Issues and Solutions are temporary workaround solutions to allow returns to be e-filed. Find answers about advance payments of the 2021 Child Tax Credit.

Cofotoisme Getty ImagesiStockphoto. Businesses and Self Employed. The expanded child tax credit for 2021 isnt over yet.

To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Make sure you have the following information. Letter 566-J ICL 30 Day Combo.

As of this writing the IRS has only acknowledged two of the three problems. Letter 525 General 30-Day Letter. A group of parents who received their July payment via direct.

These updated FAQs were released to the public in Fact Sheet 2022-07 PDF February 1 2022. TAS is an independent organization within the IRS whose employees assist taxpayers who are experiencing economic harm who. Child Tax Credit Portal.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. The Biden administration has expanded the Child Tax Credit for 2021 to 3600 for kids up to age six and. But there still may be some last-minute hurdles to overcome.

Contact the IRS as soon as possible from 7 am. IRS Warns of Wrong Amounts Heres What You Should Do. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit.

That comes out to 300 per month and. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Starting 15 July the IRS will begin sending advance monthly payments to parents for the 2021 Child Tax Credit.

A separate Known Issues and. Do not use the Child. File a free federal return now to claim your child tax credit.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. More In Tax Pros.

Warning as Americans blocked from getting 300 child tax. Most families received half of the credit in advance via monthly payments last year but theres still more money to be. Known Issues and Solutions.

This will allow you to claim if eligible the missing payment with your Child Tax Credit on your 2021 return. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. Issues arising from December payments that were returned and issues arising from alternating.

Letter 1862 Initial Contact Letter SFR Program. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit. The IRS is expected to send out the first advance child tax credit payment to millions of American families in roughly two weeks as part of President Joe Bidens 19 trillion.

Letter 2194 Alternate Minimum Tax Proposal Letter.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

First Glitch Of The Tax Season Is Here That Irs Child Tax Credit Letter May Be Inaccurate

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit Irs Unveils Address Change Feature For September Payment

Irs Cp 08 Potential Child Tax Credit Refund

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com